For most companies you analyze by using the change in working capital in this way the FCF calculation and owner earnings calculation is similar as it was for Amazon and Microsoft. The working capital changes that affect FCFF are items such as Inventories Accounts Receivables.

Change In Net Working Capital Nwc Formula And Calculator

Working capital increases.

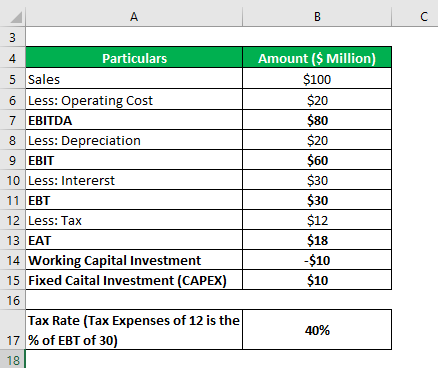

. Basic Example of FCFF Free Cash Flow to Firm Calculate the FCFF for 2008 in the following example. Net Working Capital NWC 75mm 60mm 15mm. The reason why we subtract out the change in working capital is the fact that we would either come up with a decrease in cash flows if the change is positive or an increase in cash flows if the change is negative.

As for the rest of the forecast well be using the. Cash on hand varies for different companies but having. Of the outflows in the cash from investing section the line item that should be accounted for is CapEx.

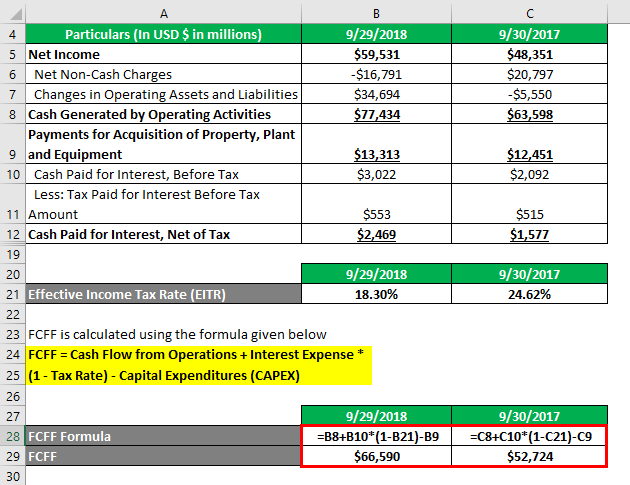

FCFF Formula EBITDA FCFF If we start the calculation from EBITDA the minor difference is that DA is subtracted and then added back. Changes in Working Capital. Owner Earnings 8903 14577 5129 13312 2223 13084.

BLOG10 Select your Premium Package. FCFF in terminal year EBIT6 1-t - Rev6-Rev5Working Capital as of Revenue 82061 1-036 - 13277 39242 millions Cost of Equity during stable growth phase 750 100. Current Operating Assets 50mm AR 25mm Inventory 75mm.

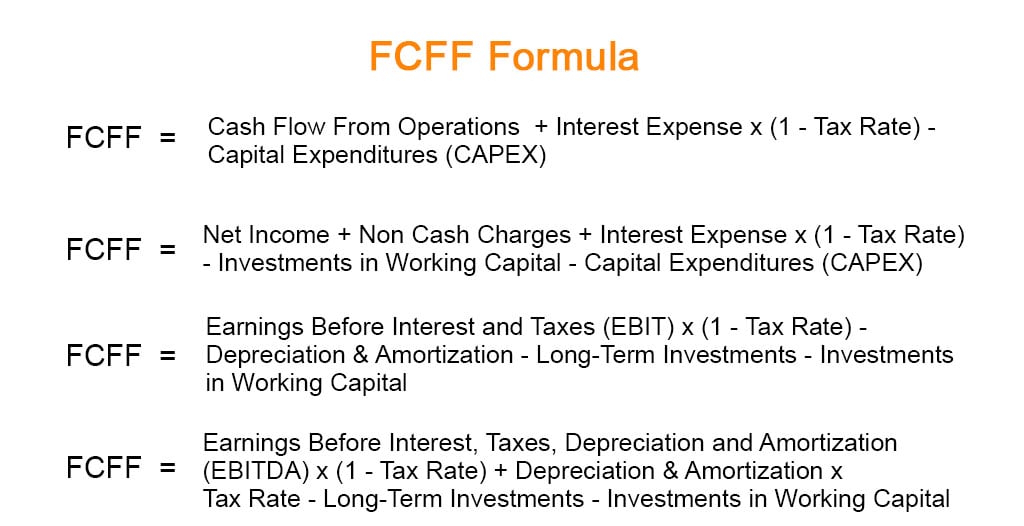

FCFF NI NCC im X l - tax rate - FCInv - WCInv where. Check out the video to learn what each of them is. Heres the formula for free cash flows Ill be referring to.

The formula for changes in non-cash working capital is. Change in working capital investment current assets cash and cash equivalents current liablities ST debt current portion of LT debt. Notice rhat nec income does not represent free cash flows defined as FCFF so we have to.

This definition of working capital excludes cash and cash equivalents and short-term debt notes payable and the current portion of long-term debt payable. Changes in working capital -2223. Free cash flow for the firm FCFF is a measure of financial performance that expresses the net amount of cash that is generated for a firm after expenses.

The formula you have is the FCF to the firm. Changes 2017 AR 2016 AR 2017 Inventory 2016 Inventory 2017 AP 2016 AP. NI net income NCC noncash charges Int inrerest expense.

Free cash flow decreases. However the FCFE are after net debt issues or payments and become more difficult to estimate when leverage is changing over time. For some types of businesses the effect of working capital can make a considerable impact on how much the cash flows will actually.

Under ordinary operating conditions many if not most companies have positive working capital current assets exceed current liabilities so forecasted increases in revenues require additional working capital investments and free cash flow is reduced all else held constant. If we calculate terminal value based on a year of high growth we are assuming the level of capital expenditure and working capital investment required to support the high growth will also remain at the same level perpetually which is definitely not the case when the growth rate drops to 3 at 93 growth changes in working capital is 118k. FCInv fixed capitaJ investment capiral expenditures WCInv working capital investment.

Hopefully this free YouTube video has helped shed some light. Limited Time Offer. The more free cash flow a company has the more it can allocate to dividends.

FCFF Calculator Click Here or Scroll Down The free cash flow to firm formula is capital expenditures and change in working capital subtracted from the product of earnings before interest and taxes EBIT and one minus the tax rate 1-t. FCF EBIT1-Tax Rate Depreciation and Amortization Capital Expenditures Increases in Net Working Capital NWC If you have an increase in net working capital you have more current assets than liabilities than you did in the previous period. 22 Apr 2017 at 737 am.

It still counts as cash that is tied into running the day to day operations of the business. Given those figures we can calculate the net working capital NWC for Year 0 as 15mm. Save 10 on all 2021 and 2022 Premium Study Packages with promo code.

Therefore - subtract from or add to FCFF where applicable. From the Current Assets Current Assets Current assets refer to those short-term assets which can be efficiently utilized for business operations. Done consistently the FCFE and the FCFF should give the same value for equity.

-2572 Change in Net Working Capital Non Cash Yr 2. FCFE Formula FCFF Interest x 1-tax Net Borrowings. FCFF is calculated from net income as.

The FCF Formula Cash from Operations - Capital Expenditures. Moving to cash flow statement - net income is up 60 but change in working capital is a 100 outflow increase in AR resulting in a 40 decline in cash. Do not include non-operating current assets and liabilities eg.

You include change in cash as a part of change in overall working capital. Then capital expenditures CapEx and the change in net working capital NWC is deducted. FCFF is the cash flow available to a firms capital providers after deducting operating expenses working capital expenses and fixed capital investments.

Below is the calculation for working capital. Free cash flow FCF is the money a company has left over after paying its operating expenses and capital expenditures. FCFF Net Income Non Cash Charges Interest Expense 1 Tax Rate Investments in Working Capital Capital Expenditures CAPEX FCFF 18 20 18 10.

Hello Dheeraj can you please explain me why in FCFF formula the changes in working capital are calculated as current year 2008 minus previous one 2007 but in the FCFE formula is the other way around based on the 2 examples you showed. Current Operating Liabilities 40mm AP 20mm Accrued Expenses 60mm. The free cash flow to firm formula is used to calculate the amount available to debt and equity holders.

Free Cash Flow For The Firm - FCFF. If a company stock piles a ton of cash you can treat some of it as excess cash and tack it back on after youve completed the entire DCF valuation. FCFF the FCFF is the cash flow to all holders of capital in the firm ie the equity holders and the bond holders.

Fcff Formula Examples Of Fcff With Excel Template

Fcf Formula Formula For Free Cash Flow Examples And Guide

Free Cash Flow Efinancemanagement

Free Cash Flow To Firm Fcff Formulas Definition Example

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Change In Working Capital Video Tutorial W Excel Download

Fcff Formula Examples Of Fcff With Excel Template

Fcf Formula Formula For Free Cash Flow Examples And Guide

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Excel Calculator

Fcff Formula Examples Of Fcff With Excel Template

Free Cash Flow Meaning Examples What Is Fcf In Valuation

Free Cash Flow To Firm Fcff Formulas Definition Example

Change In Working Capital Video Tutorial W Excel Download

Change In Net Working Capital Nwc Formula And Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)